Credit Scoring

How it affects your home buying options

How it affects your home buying options

Credit scoring is a statistical method that lenders use to quickly and objectively assess the credit risk of a loan applicant. The score is a number that rates the likelihood you will pay back a loan. Scores range from 350 (high risk) to 950 (low risk). There are a few types of credit scores; the most widely used are FICO scores, which were developed by Fair Isaac & Company, Inc. for each of the credit reporting agencies.

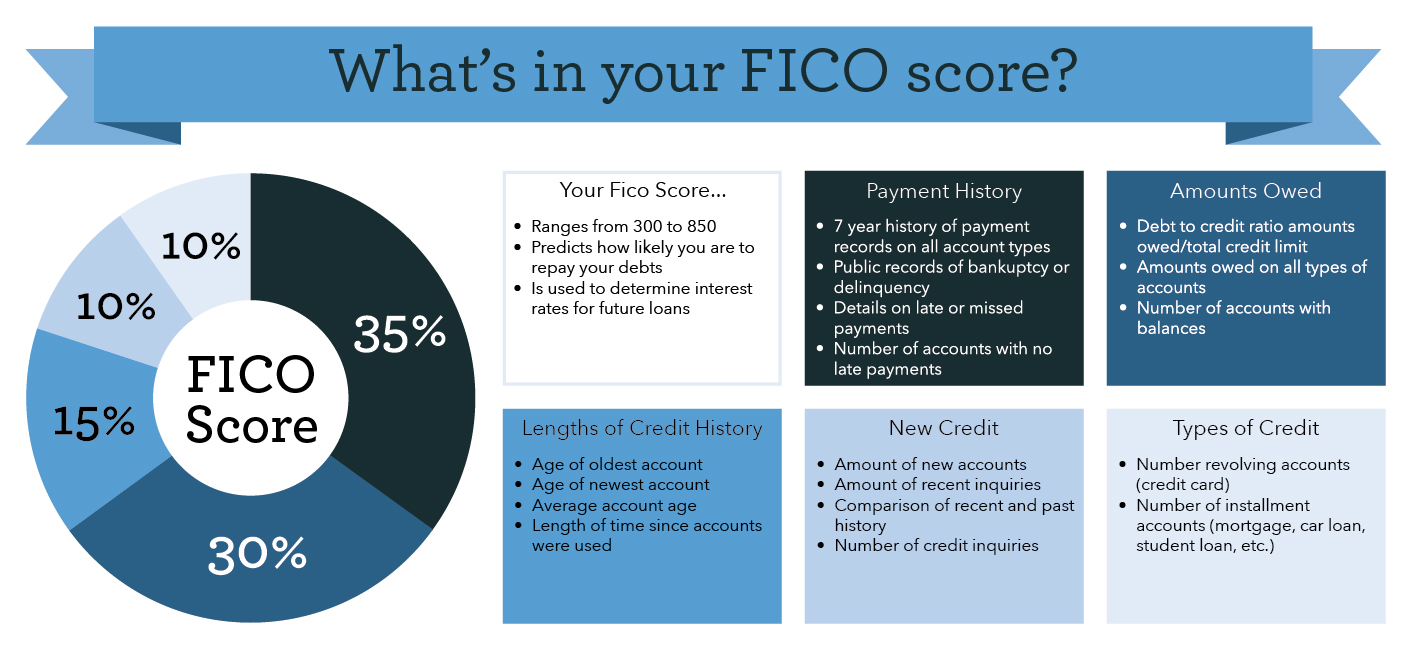

Credit scores only consider the information contained in your credit profile. They do not consider your income, savings, down payment amount or demographic factors like gender, race, nationality or marital status. Past delinquencies, derogatory payment behavior, current debt level, length of credit history, types of credit and number of inquiries are all considered in credit scores. Your score considers both positive and negative information in your credit report. Late payments will lower your score, but establishing or reestablishing a good track record of making payments on time will raise your score. Different portions of your credit file are given different weights.

You can’t depend on your eyes when your imagination is out of focus.

At Maine Home Connection, we channel our unwavering commitment and passion into delivering unparalleled real estate excellence.

If you’re contemplating a real estate transaction, seize the opportunity to empower your decision with our most current Buyer or Seller guides.

Imagine More!